Pablo Gómez, Director

Banks have always been the main source of funding for Spanish companies, particularly SMEs. However, for some years now, “alternative financing” has been the topic of many headlines in the business sections of media outlets. In fact, this concept has gained ground and is becoming an increasingly common source of finance for companies thanks to its complementarity with traditional financing.

Complementarity is the key word on which the growth of these new solutions has pivoted. At IMAP Albia Capital, we frequently refer to it as non-bank financing because it is not necessarily an alternative to traditional bank financing, but rather the two can be combined, enabling companies to diversify their sources of finance or undertake other types of projects for which traditional financing is not compatible.

This means that alternative financing or non-bank financing makes it possible to connect investors with businesses that need funding, and this is done through various types of entities unrelated to banks, resulting in a new source of finance.

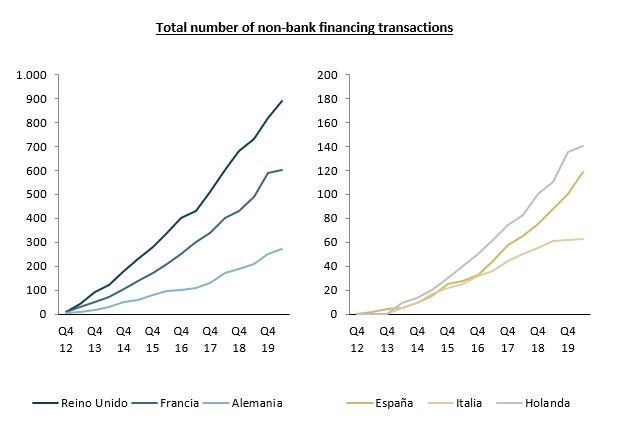

As shown in the two figures below, these types of solutions have become established in recent years in markets such as the United Kingdom, France and Germany, with approximately 900, 600 and 300 registered transactions in total, respectively, up to the start of 2020. On the other hand, there is strong potential for growth in other European markets such as the Netherlands, Italy and Spain, where there were fewer than 150 transactions in each of those countries during that same period.

*Source: Deloitte Alternative Lender Deal Tracker Autumn 2020

The non-bank financing market in Spain is experiencing significant growth and represents one of the top investment priorities for many management companies. However, liquidity measures put in place by central banks and governments in an attempt to reduce the impact of COVID-19 during 2020 and 2021 have temporarily slowed down this growth.

To introduce some of the non-bank financing solutions available on the market, we will use the following three types of funding that will help us classify them in the best way possible: (i) Corporate funding, (ii) Working capital financing and (iii) Asset-based lending.

- Corporate funding

This first category includes everything related to the finance strategy for a company’s operations or its balance sheet structure.

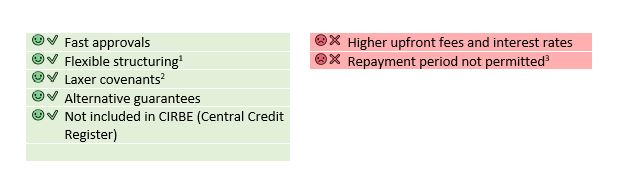

This is where one of the key players of the non-bank financing market enters the scene: direct lenders. These private capital funds, managed by specialized management entities, are carrying out a significant number of transactions thanks to the benefits they offer over competitors:

1. Restructuring options: grace period, bullet repayment (only interest is paid annually and a lump sum payment is made for the entirety of the outstanding loan amount at maturity), PIK or Payment in Kind (interest is not paid although it is accrued, and the total amount is due when the loan matures), etc.

2 Covenants: clauses added to loan contracts with the aim of “guaranteeing” that the lender will be repaid. These types of clauses limit a company’s ability to maneuver and restrict certain transactions, which in the case of non-bank financing, may have fewer requirements.

3 There may be an initial grace period in which the loan cannot be amortized, thereby guaranteeing that the lender will receive a minimum amount of interest.

Financing a merger and acquisition, consolidating the shareholder base by purchasing shares from minority interest holders, a liquidity event with dividends, refinancing bank debt, or funding development and growth are examples of when these types of solutions are applied.

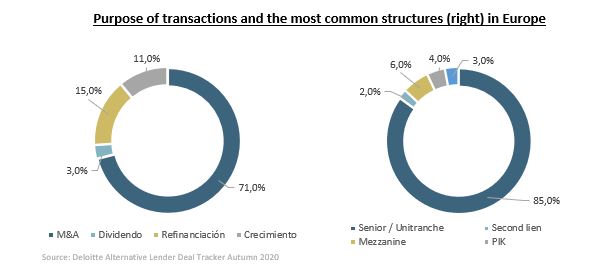

As shown in the figure below, the M&A market has shown the most traction to date in making use of these solutions. Specifically, 71% of non-bank financing transactions in Europe are linked to these types of actions, and the remaining 29% are for liquidity events with dividends, refinancing or growth/development.

It can also be noted that subordinated debt structures, which have the greatest risk for lenders, are currently a residual percentage, and 85% of the transactions registered in Europe are for senior/unitranche debt.

Crowdlending platforms (collective financing mechanisms), whose activity has also grown significantly in recent years, offer solutions that are similar to the ones described in the first group, although for smaller companies that are usually limited to up to €5 million in funding.

- Working capital financing

Working capital financing allows a company to make short-term payments through its operations. The instruments most commonly used for working capital financing are recourse and non-recourse invoice discounting (factoring), discounting promissory notes and confirming.

Alternatives unrelated to traditional banks have also emerged for these types of solutions, in which technology is made available to users so they can manage processes quickly and 100% online. And just like debt funds o crowdlending, this type of financing is not included in CIRBE, thereby improving and diversifying a company’s debt structure in light of their negotiations with banks.

Working capital financing is key for businesses that have major investments in working capital (fixed assets – fixed liabilities) and it is oftentimes what banks cancel first when a company is facing financial difficulties. As a result, it is particularly important to diversify these sources of finance, which are essential for a company’s regular operations.

- Asset-based lending

Lastly, asset-based lending (rentback & leaseback) is another way to obtain liquidity in a relatively short period of time and without affecting business so companies may continue using their assets to operate.

This type of financing entails selling a series of company assets to a third party, and then signing a rentback or leaseback agreement. The assets included in this transaction should meet the following criteria: (i) they must be in good condition and their preventive maintenance up to date, (ii) they must sell well in the asset secondary market, and (iii) the LTV (loan to value – ratio of a loan to the value of the asset purchased) will depend on the risk and condition of the assets.

Non-bank financing, diversification, growth, flexibility, etc., are some of the concepts discussed in this brief summary aimed at informing readers about some of the leading solutions available in the alternative or non-bank financing market, which could be of great interest for companies to explore. These new solutions are here to stay and we will progressively embrace their use because, as stated in the beginning of this article, thanks to their complementarity with traditional financing and multiple benefits, they have the potential to become great allies for many companies.