Aritz Laso, Analyst

“It is a time to act, given that a passive attitude could mean that this new wave of changes becomes too strong to resist and the company will be left behind.

The challenge is big, and the opportunity is unique”

It is well known that the automotive sector finds itself in one of the greatest periods change and instability it has faced in recent years: the ecological transition (new standards to reduce emissions, the diesel crisis…), cut-price competitors, as well as political instability (the trade war currently going on between the United States and China, the North-American free-trade agreement …), all mean that the sector is facing one of the greatest challenges in living memory.

The uncertainty that the world’s main motor manufacturers are enduring has a knock-on effect on the suppliers of automotive components. However, in Spain, manufacturers of automotive components have managed to keep their sales afloat with growth of 1% in 2019, in spite of the 6% drop in registrations and exports reported by the car manufacturers operating in Spain, but there is concern about the future in the short and medium term.

Future of the sector:

Despite this uncertainty and the negative forecasts, the main analysts and companies within the industry expect a period of flat sales due to the uncertainty, but no falls in global demand. In 2019, cars worth €98m were manufactured in the world, and this figure is expected to rise to €100m in 2020 and €113m in 2025. Trends are changing, and it will be necessary to adapt to them, but the sector will continue to be one of the main economic drivers.

The uncertainty and the changing situation that car manufacturers are experiencing has been passed on to their suppliers, and as such the companies that form part of the automotive-components industry need to adapt as flexibly as possible to the main manufacturers if they want to hold on to their leading position in the sector.

As with all situations of change and uncertainty, there are risks, but there are also increased opportunities, and faced with these, managers have to take decisions that will define the future of their companies. The only thing that is certain is that the sector is undergoing change, that the game has begun, and that it will be essential to get hold of the best cards.

M&A activity in the component sector:

At IMAP Albia Capital we have observed how there has been a great deal of mergers & acquisitions activity in recent years, both in Spain and in Europe. Companies are examining and acquiring opportunities that will allow them to establish themselves as international benchmarks: increasing their size, global presence, and branching out into complementary and innovative activities that can boost their growth.

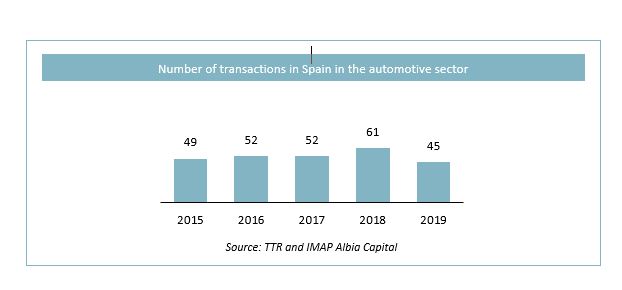

Despite the uncertainties, the M&A market is active, given that we find ourselves in a situation where there is a major increase in opportunities in the sector. According to TTR, only in 2019 there were 45 transactions within the automotive sector in Spain.

Similar trends have been observed in the data at a European level, and while the number of transactions might be slightly down, volumes are still significant. With regard to valuations, there have not been any great changes, with the average coming in at around 7x EBITDA. It should be pointed out that there are wide variations in the multipliers being observed, mainly in accordance with the added-value of each company, given that many of the acquisitions are oriented towards benchmark companies within the innovation field.

The rationale for these transactions has a major strategic component: to acquire technology, volume, and presence in the international market. These are the main reasons for the corporate shifts.

At IMAP Albia Capital, we have observed that if we isolate out these innovative companies and focus on the so-called ‘traditional’ companies, the multipliers have values of between 4x and 6x EBITDA across the past 5 years.

The key to understanding this situation is that companies perceive that the solution to this uncertainty is to get larger, have more global presence, and to act competitively, with innovation and talent, and in order to do this the quickest route is via corporate transactions, through acquisitions or mergers.

The majority of the transactions are being carried out on the basis of a series of critical factors which are set forth below:

- The search for products with higher added value and integration of processes: The effect of cheap labour is no longer the fundamental competitive factor, and as such offering products based on innovation, efficiency, and high added value is critical.

- International presence: Global reach is a determining factor in being able to supply customers. Many companies acquire businesses that allow them to have a presence in other markets. Growth in the automotive market will come from outside Europe, and as such local companies will have to become small multinationals with a global presence.

- Emphasis on diversification: With the increased vehicle mix (from internal combustion to electrics) and the changing business model of automotive manufacturers (from manufacturers to mobility providers), companies will have to be able to offer a broad range of products, adapting to the needs of the manufacturers.

Other aspects that lead us to act

As it can be seen, the sector is looking forward in the short term to the biggest revolution in its history, and as such all companies that form part of this market will need to take decisions and take advantage of the increasing opportunities that will arise, in order to capture the new form of growth in the sector.

Growth opportunities are wider than ever, mainly due to the technological changes that are occurring and which are already becoming a reality, such as using lighter materials and the integration of digitalization and connectivity. In this transition towards vehicle electrification (it is expected that they will represent 10% of new European vehicles in 2025), hybrid vehicles have a significant role, needing a higher number of components than current vehicles. Furthermore, the industry is taking the arrival of driverless cars for granted, the so-called industry 4.0. All of these can be springboards towards growth.

Meanwhile, it is expected that the importance of the suppliers of the automotive manufacturers will increase to the point that they become strategic partners. Nowadays, 75% of the value of a vehicle is set by the suppliers, and it is expected that this percentage will increase, with a greater role in the design and development of solutions from ever-earlier stages, given that the main vehicle manufacturers will only have limited resources with which to invest in a varied mix of vehicles.

At IMAP Albia Capital we argue that in order to run a successful and competitive business in this industry in the short-to-medium term, companies need a combination of critical mass, solid financial capacity, global reach, products with high added value, investment in innovation, and capacity to adapt to vehicle manufacturers.

IMAP Albia Capital, as M&A consultant

At IMAP Albia Capital we have not been detached from the movements in the sector, participating in various transactions connected to the automotive sector.

At IMAP Albia Capital we have advised various companies within the sector, some in their expansion stage through acquisitions, and others which for reasons of lack of continuity or succession have been taken over by groups with a higher volume, thereby securing their future. We show below some of the 31 corporative consultancy operations carried out by IMAP Albia Capital in the automotive sector over the past 15 years:

At an international level, we at IMAP have been able to advise on 38 transactions connected to the automotive sector since 2015. Specifically, in the past year there have been 8 transactions, of which we may highlight the following:

Conclusions

Times of uncertainty are also times of opportunity, and they require taking strategic decisions of great significance. The suppliers of motor manufacturers are increasing their role in the sector, and companies that wish to maintain a successful business need to position themselves to face these changes and opportunities.

It is a time to act, given that a passive attitude could mean that this new wave of changes becomes too strong to resist and the company will be left behind.

The challenge is big, and the opportunity is unique.