The annual report on corporate transactions for the sale and purchase of companies carried out by the different members of the global IMAP organization for the period from July 2019 to June 2020 has recently been published.

During the period considered, 234 transactions were carried out with a value of USD 13 billion. In this number of transactions, the pre-COVID period to the post-COVID period is clearly distinguishable, for a clear slowdown has been appreciated. However, in the first six months of 2020, seventy-three M&A transactions have been closed.

Obviously, the situation derived from the coronavirus is also affecting the sales of companies, and there is enormous uncertainty regarding the evolution of 2021.

However, on a global basis, we observe that companies are moving to an offensive strategy in M&A transactions. This trend affects both opportunistic buyers and Private Equity, Venture Capital and strategic investors. By sectors, the technology sector continues to be very attractive and in particular the areas of health and Fintech.

The following link https://albiacapital.com/publication/view/imap-dealbook-2019-2020/ includes details of these transactions (plus the most relevant ones of the last half of 2018 and first half of 2019) classified by sectors and activity.

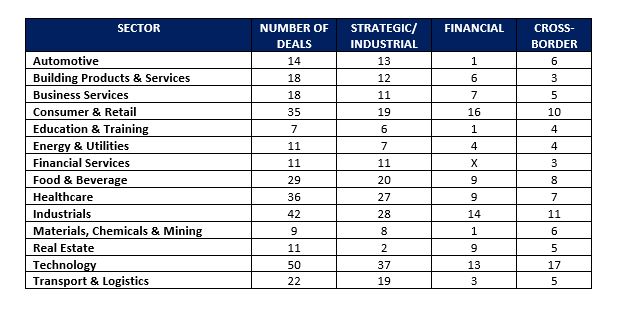

Summarizing, and analysing whether the buyer is strategic (Industrial) or has a financial profile, we can draw some conclusions on 313 published transactions. The specific weight of transactions between companies from different countries is also outlined.

If we analyse in detail the rationale for M&A transactions by sectors, we can reach the following conclusions.

If we analyse in detail the rationale for M&A transactions by sectors, we can reach the following conclusions.

Automotive: Corporate transactions continue to be a basic factor in companies’ strategy to gain size and acquire new technologies/value. These transactions have a high international component.

Consumer and Retail: A very active sector in transactions with a significant presence of financial investors who consider it an attractive sector in the medium term. Although this trend will be affected in the short term by the COVID-19 effect, it is equally certain that they are medium and long term investments where consumption will rebound.

Food and Beverages: It has behaved dynamically with a preponderance of corporate transactions with a strategic sense of market/new products incorporation. The interest of financial investors is also considerable.

Health: Before the pandemic it was already an attractive sector. It was undergoing a clear growth and concentration process among companies and it was becoming increasingly internationalized. COVID19 will lead to an increase in transactions.

Industry: The growth process through the purchase of companies is still present in many companies’ strategy, were cross-border transactions play an important role.

Technology: Once again, companies with technological content are the most dynamic in corporate transactions, where strategic sense prevails in decisions to buy or sell companies. As the technology sector is global in scope, transactions between companies from different countries have a high presence since, in addition to markets, knowledge is sought.

Transport and Logistics: It follows the dynamic of concentration and growth of companies through the acquisition/integration of companies and services within the markets themselves.

In conclusion to that happened in this period, from the experience of IMAP Albia Capital, we can affirm that:

- M&A activity is part of the growth strategy of companies due to its speed and efficiency.

- For many of the sectors, gaining size is not an option, it is an obligation for the survival of companies.

- The specific weight of the transactions in different countries shows that companies are thinking globally and considering entering into new geographic markets through the purchase of local companies, which is one of the keys to internationalization.

- Technology and health are sectors with great dynamism and they will continue to be so. This trend denotes the evolution of the economy towards higher value activities, where interesting processes of concentration and specialization are taking place.

- Financial investors are present in all sectors and acting in line with their goals of making their investments profitable. However, the industrial, consumer and technology sectors remain the favourites to invest in.

We hope this information is useful and helps to reflect on how to face corporate strategy and the continuity of our companies.

Although COVID-19 is having a great impact on a personal and business level, we must however turn it into an opportunity to rethink, reposition ourselves and act accordingly.