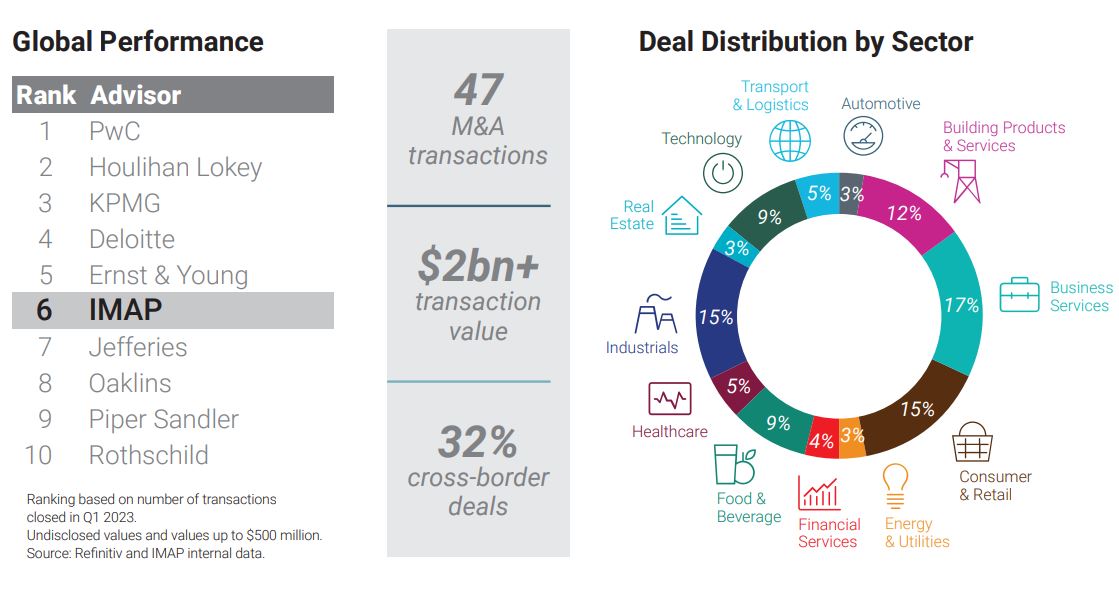

IMAP closed 47 M&A transactions valued at over $2 billion in the first quarter of 2023. While the figure was down from previous quarters it was not as low as initially expected.

IMAP closed 47 M&A transactions valued at over $2 billion in the first quarter of 2023. While the figure was down from previous quarters it was not as low as initially expected.

At the macro level, interest rate hikes, persistently high inflation, financial market instability, and fears of a recession put a damper on dealmaking activity. At the transaction level, IMAP dealmakers have reported that sellers are struggling to find good buyers and disappointed with relatively low valuations, while the lack of financing is diminishing appetite among potential acquirers. Despite these challenging conditions, the market is not entirely paralyzed. High quality businesses with strong margins and defensive growth profiles continue to attract interest from well positioned strategic buyers. Financial buyers have been much less aggressive due to the high cost of capital.

Business Services, Industrials, Consumer & Retail, and Building Products & Services were the most active sectors, accounting for 60% of total IMAP deal volume. Approximately 32% of the transactions were cross-border, which is consistent with previous quarters and reflects the IMAP’s global nature. The bulk of IMAP’s Q1 deals involved a target company in either Europe or North America, with deal flow slightly more limited in Asia and Latin America