Throughout the life of companies there are times when their activity is not able to generate enough resources to meet the commitments made with suppliers, staff, administrations and banks. This situation will unfortunately be the one that many companies will have to face in the coming months due to the blackout ,not hibernation, of the economic activity originated by COVID-19.

While the various administrations have adopted certain mitigation measures, including tax deferral, ERTEs, government-backed loans or Autonomous Communities,etc. , such measures shall serven only to provide the liquidity necessary to deal with the blackout period (which is not small).

However, once it returns to the activity, a high number of companies will face a very different normality with greater indebtedness and an uncertain recovery landscapeor, therefore, with needs to accommodate the maturities of their debt to the cash flows of their activity. In short, in the coming months the new normal will bring us old acquaintances such as restructurings and refinancings.. The continuity of the companies in this situation will depend on the management of the problem in a decisive, professional and appropriate methodology.

In this context, it is necessary to consider a number of keys to address the situation that is looming.

Key 1. Realism and anticipation

Although it is hard, it is essential to assume that the company is facing a crisis. In addition, it must be done well in advance to contain the “hemorrhage” when it is still manageable and, on the other hand, for the measures taken to have the necessary time to take effect.

Key 2. The problem is not (only) financial

Finance is but the result of a business activity so the lack of liquidity, the failure to meet payments and, ultimately, financial problems are just the tip of the iceberg of a more complicated business situation. It is of no use to attack the financial problem by seeking capital or refinancing debt if the causes and business problems that cause it are not also attacked.

Key 3. Liquidity rules

Cash is King in the moments of crisis. We all know that companies die from the box (the lack of, of course) and, interestingly, in crisis situations, it nevertheless surprises the frequency with which companies undertake speculative purchases of material taking advantage of the fall in prices, or produce against stock, or intensify their presence in fairs, or invest in machinery that improves their productivity. In short, they are undertaking actions that will bring future results at the cost of burning a treasury that the company cannot afford. Under normal conditions, the above performances would be absolutely plausible however, at this time the box must be stretched:

- Adjusting costs to predictable revenue in the coming months.

- Delaying all that (investments, promotions, fairs, …) does not produce immediate income.

- Identifying ways to make active liquids that are not productive, not affected by or not critical to exploitation.

- Negotiating with creditor payment terms.

- Adapting labour costs with containment and flexibility measures.

Key 4. Investors are looking for non-troubled projects

In crisis situations is when you miss an investor who contributes capital to plug the hole. Bad news: Investors invest in projects not in trouble. Therefore, hwoe to do homework, take steps to overcome the crisis situation and rebuild a project. And this should be done by those within the problem, third parties are not invited to get into the problem. It should not be forgotten that those investors who invest in these crisis situations aim to refloat with their means and to pay with the value of the healthy company and, therefore, do not need the current shareholders (or part of the management team).

The above keys to action in the face of a crisis situation are based on common sense: (i) taking the reason for the problem as soon as possible so that the hole does not get bigger, (ii)addressing the problem as a whole, not only its symptom (lack of liquidity), (iii)usingthe resources with head to last until better times come and (iv)not waiting for others to solve what we have tosolve.

With the above premises clear, it is time to define a Plan and execute it.

Restructuring or Viability Plan:

The first step is to define the objectives of the restructuring that will be reflected in a Restructuring Plan or Viability Plan. This Plan defines the actions to be taken to return the company to profitability and/or the restoration of financial balance.

The actions provided for by the Plan shall be, inter alia, operational, commercial, labour, strategic and financial. It will also contain faster implementation actions (quick wins) and others in thelonger term that will allow to achieve a sustainable repositioning of thecompany.

Implementation of the Plan

Giventhe Plan, it is vitally important to establish the form of implementation,with two key figures::

- The person responsible for implementing the Plan: a key figure on which the responsibility lies with the implementation of the actions designed in the Plan. This figure may exist within the organization or resort to someone outside it. In this regard, it should be noted that company managers are generally accustomed to management in “normal situations” of the market. When we find ourselves in a “specialsituation”,it is often necessary to strengthen the management team with advisors and expert managers in crisis situations so that dotin the plan and its execution of the necessary credibility before shareholders, workers, banking, creditors and public institutions. situación especial

- The Plan MonitoringCommittee: which sets the guidelines, lends its support to the plan implementation manager and is the ultimate guarantor and ultimate accountable to the governing body and shareholders of the implementation of the Plan.

It should be noted that traumatic situations are the contribution of specialists in the design and execution of the Plan exponentially increases the possibilities of return to the way of profitability by the company.

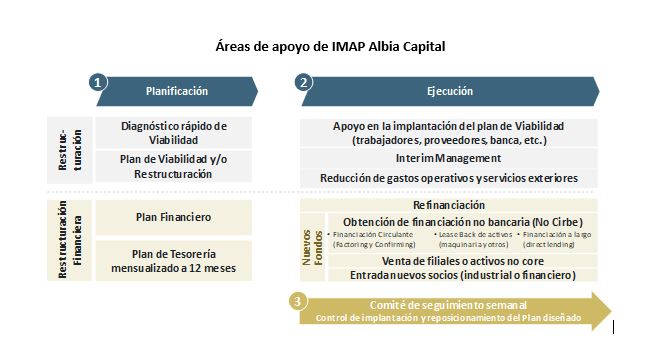

Contribution from IMAP Albia Capital

A differential factor of IMAP Albia Capital services in situations such as those referenced is our commitment to results. Our goal is not only to prepare the analyses or feasibility plans needed to define and share what needs to be done. Our goal is to accompany and commit ourselves to the implementation of those actions that we have defined in the Plan. Hence our commitment is to the results and we work closely with the client.