IMAP Albia Capital and Empresax combine forces to emerge as one of the main firms in M&A practice throughout Spain

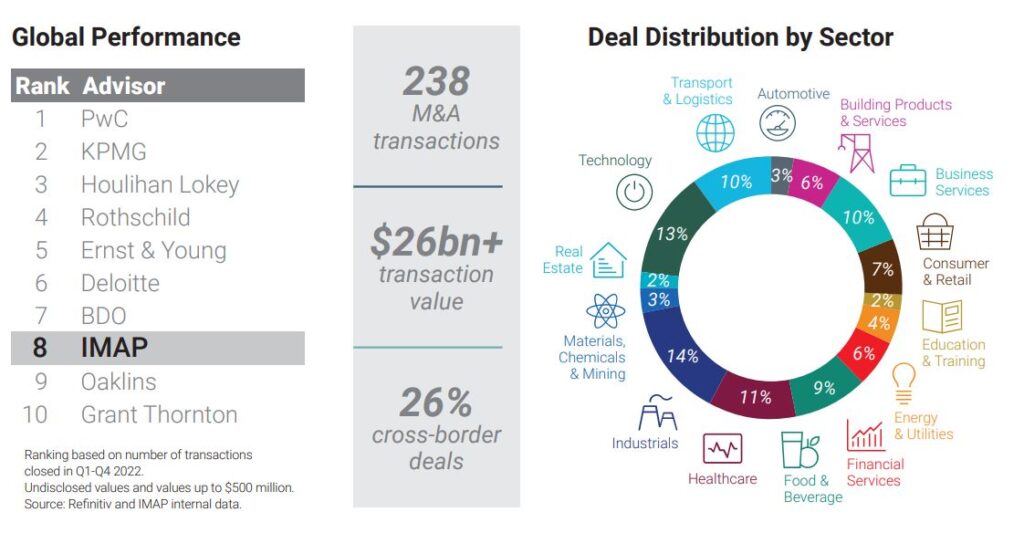

IMAP Albia Capital takes a new step in its growth plan by integrating Empresax, a boutique specialized in corporate transactions, led by Francisco José Hidalgo-Barquero and Ricardo Dávila, thus positioning itself as one of the leading companies in mergers and acquisitions (M&A) in Spain. According to Fernando Cabos, partner at IMAP Albia Capital: “As in […]