Fernando Cabos, Partner at ALBIA for number 37 of INDUSTRIA COSMÉTICA MAGAZINE

Consumers continue to allocate a growing share of their budgets to products related to wellness and beauty, as reflected in the spectacular growth figure of the perfumery and cosmetics sector in Spain, 12.1%, in contrast to the modest increase of 1.8% in general consumer spending (data from Stanpa and BBVA, respectively, referring to the 2023 financial year). The outlook for the coming years projects a growth of the Beauty sector globally of 6% per year, reflecting the growing importance that the population, increasingly aging and aware of the early detection of diseases, gives to health, well-being and beauty. Another factor that is driving the growth of the target audience and, therefore, of the demand for beauty products, is the fact, sometimes controversial, that the age of access to the consumption of these products is being significantly reduced. This trend not only expands the market, but also ensures a new customer base willing to invest in their health and beauty from an early age.

In this favourable environment, the barriers to scale persist derived from the idiosyncrasy of the sector that requires significant investments in R+D, marketing and in growing regulation that are more easily digested by companies of a certain size that have the capacity to allocate significant funds to the development of innovative products, adapted to changing consumer preferences. as well as the construction of solid and recognized brands in the market with differential products.

Spanish companies in the sector, so respected worldwide, find in many cases that their size is still a limitation. According to a study we recently carried out, 65% of companies in this sector do not reach 15 million euros in turnover. In a sector that benefits from significant economies of scale, this translates into a profitability differential of more than 7 percentage points. Companies with a turnover of more than 100 million euros obtain an average EBITDA margin of 14.4% in contrast to companies that do not reach 5 million euros in turnover, almost 50% of companies in the sector in Spain, whose average EBITDA margin is 7.3%.

This disparity in profitability has led owners and shareholders of private companies to seek mergers and acquisitions (M&A) strategies to reach a larger dimension that allows them to benefit from economies of scale and capitalize on the high growth expectations of the sector to reach the next level of development of their companies.

This has led to intense M&A activity in the dermatology and cosmetics sector both by companies in the sector and by financial investors who have set their sights on the beauty sector, where they find innovative companies, with worldwide prestige capable of developing projects with growth rates and profitability higher than those of other sectors.

The high fragmentation of the sector is one of the main drivers of this energetic M&A activity, which occurs in various growth contexts: from vertical integrations that allow the integration of margins, market consolidation movements, or entry into new markets, products or technology.

The protagonists of these M&A movements are Spanish companies that wish to consolidate their position in the market, foreign companies attracted by the possibility of positioning themselves quickly in an atomized market or financial investors attracted by the possibility of leading growth projects in a sector in which, as noted above, the larger size results in greater profitability. Below we delve into the strategy behind the operations led by the different types of protagonists.

On the one hand, several Spanish companies in the dermatology and cosmetics sector are leading acquisitions with the aim of sectoral consolidation both nationally and internationally, allowing the diversification of the range of products and business lines, as well as access and entry into new markets.

The greatest exponent of this movement is Puig, the Catalan cosmetics, perfumery and fashion giant that has invested 2,500 million euros in M&A transactions since 2011, strengthening its competitive position in key markets and accelerating its growth in new categories and emerging markets. With this strategy, Puig has managed to diversify and expand its portfolio, becoming one of the most relevant players worldwide in its sector. The company intends to continue its strategy of inorganic growth through acquisitions, highlighting its interest in further expanding its portfolio of strategic brands.

There is also a large influx of international companies entering the national market due to the current attractive market configuration in Spain, which represents great potential due to its atomization, which makes it possible to address geographical consolidation strategies. Through these acquisitions, international companies gain direct access to the national market and achieve a rapid position in the fourth European market in terms of size, while acquiring production and R+D+I capacities.

A recent example is that of Kao, a Japanese company of personal care products and cosmetics, which last September acquired a stake in Hello Sunday, an innovative Spanish brand specializing in beauty products with sun protection. This transaction reinforces Kao’s strategy to expand its presence in the European market and to offer complete skincare solutions, integrating a highly demanded SPF line.

Finally, financial investors (private equity ) have burst onto the scene and have directly or through their investee companies accounted for nearly 30% of operations in the sector. Private equities are attracted to the sector due to the expectations of growth and resilience, the possibility of promoting and accompanying companies’ growth projects, and the potential to consolidate the positioning of companies through the incorporation of other companies (add-ons) that allow synergies to be obtained with the companies in its portfolio and access economies of scale that allow it to increase the profitability of its investee companies.

A recent example is the case of Artá Capital, which last December acquired a majority stake in Viokox, a prominent cosmetics company known for manufacturing depilatory products for Mercadona and other chains. This transaction will enhance Viokox’s growth through investments in R+D, international expansion, expansion of the product portfolio and increase in production capacity. Likewise, possible complementary acquisitions will be explored to strengthen the company’s competitive position in the market.

Just as we pointed out a growth differential between the dermatology and cosmetics sector and the consumer sector, there is also a great contrast between the valuations of companies in this sector and those in the consumer sector, which have been penalized by the numerous challenges of recent years. Indeed, high energy costs, supply chain problems, inflation, high interest rates and the geopolitical situation have led to caution among investors, limiting their exposure to consumer-related sectors.

However, this has not been the case in the beauty sector, which has historically shown remarkable resilience to recession, with higher returns than the benchmark S&P 500 index. When comparing the Beauty Index with the S&P500, we see that in periods of stability and sustained growth, the sector aligns with market trends, always maintaining higher valuations, and in periods of economic downturn has shown high resilience. All this makes it a focus of high interest for investors.

In particular, the average share price of international companies in the sector in 2024 stood at 15.9x EBITDA, with average valuations that in the last five years have not been less than 12x EBITDA, reaching an average of up to 22x EBITDA in the months following the recovery from the pandemic.

Top international beauty companies quote in the period 2019 – 2024

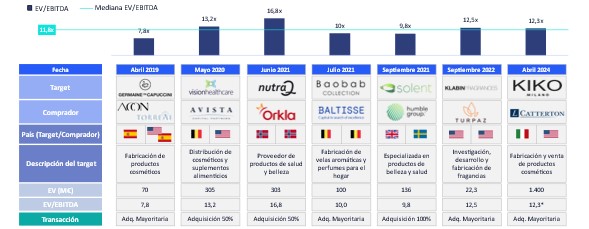

With regard to the valuation multiples observed in M&A transactions, the average multiple in recent transactions (last five years), stands at around 11.8x EBITDA, lower than that of listed companies due to the premium of listed companies for the higher liquidity factor. It should be noted that there is a high dispersion in the multiples of M&A operations mainly due to the added value offered by the subsector in which the companies operate, as well as the degree of innovation, technology and size of each company acquired.

Example of valuation multiples of M&A transactions in the period 2019 – 2024

In summary, the dermatology and cosmetics sector in Spain is experiencing considerable M&A activity due to its atomization, profitability and growth expectations, with larger companies being significantly more profitable due to economies of scale. All this means that transactions are carried out by both national and foreign companies in the sector, as well as financial investors. And another piece of good news for companies in the sector is that their valuations are high.

This frenetic M&A activity is causing a transformation of the sector in Spain as new entrants, multinationals and financial investors, in addition to bringing their different ways of acting to the sector, are more inclined to face the important challenges and invest in innovation, marketing and sector consolidation, which is changing the configuration of the sector and, In a few years, it will accentuate the distance between larger and smaller companies. This sector is also converging with the pharmaceutical and food supplement sectors. Uriach, Suanfarma or Vision Healthcare are three examples of this trend.

In the midst of this turmoil, a fundamental question arises for companies in the sector: is it feasible to continue without doing anything different or is it time to take the reins and lead a growth project? Alternatively, is it time to take advantage of intense M&A activity and high valuations to add value to the company? The decision they make now will determine their position in the future market.