[:es]

Albia Capital Partners se integra en IMAP, boutique líder en fusiones y adquisiciones en el Middle Market

Desde el 1 de enero de 2017 ALBIA CAPITAL PARTNERS pasa a integrarse en la organización IMAP como su firma exclusiva para España.

IMAP es una organización global, con presencia en 35 países, 67 oficinas y más de 350 profesionales dedicados al asesoramiento en Fusiones y Adquisiciones. En los últimos 10 años ha cerrado más de 2.200 transacciones con un valor superior a 90.000 millones de US$. De forma recurrente el 30% de las transacciones de la organización son de carácter internacional (cross-border).

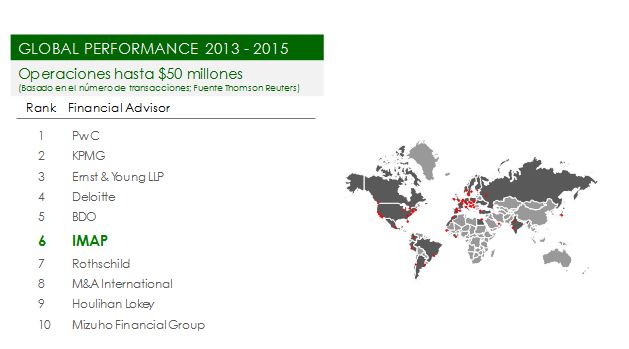

IMAP es uno de los líderes en operaciones del Middle Market, figurando en los rankings de Thomson Reuters en los últimos 3 años como sexta firma mundial en operaciones hasta 50 millones de US$ y 7ª firma mundial en operaciones hasta 100 millones de US$. Es la primera boutique con dedicación exclusiva a Fusiones y Adquisiciones en este ranking.

En este periodo, Albia Capital ha extendido el alcance de sus servicios habiendo intervenido en transacciones en países tales como Estados Unidos, India, Sudáfrica, Argelia, Reino Unido, Alemania, Kuwait, República Checa, entre otros. Esta tendencia a la internacionalización de sus servicios, en línea con las necesidades de sus clientes nacionales y extranjeros, ha derivado en su integración en IMAP.

Con motivo de su reciente integración en IMAP, Albia Capital Partners ha pasado a denominarse IMAP Albia Capital, cambiando su identidad corporativa y actualizando su página web (www.albiacapital.com) y, lo que es más importante, integrándose operativamente en la organización GLOBAL de forma que todos los clientes de Albia Capital Partners apalanquen sus proyectos en los 350 profesionales que a nivel internacional van a trabajar por su éxito.

Con esta nueva organización IMAP Albia Capital espera seguir ayudando a sus clientes a resolver y ejecutar sus estrategias corporativas con una visión, si cabe, más GLOBAL así como a ofrecer a inversores y empresas locales más opciones y mejores oportunidades. IMAP gestiona de forma recurrente entre 350 y 400 mandatos (de compra, venta y búsqueda de socios), muchos de los cuales constituyen importantes oportunidades de inversión o de integración en proyectos de relevancia GLOBAL.

En el ejercicio 2016, IMAP ha realizado en España nueve operaciones, cinco resueltas en un ámbito doméstico y cuatro ejecutadas con una contraparte internacional en las que han intervenido distintas oficinas de la Organización:

En definitiva, el equipo de IMAP ALBIA CAPITAL inicia una nueva e ilusionante etapa en su proyecto de asesoramiento en procesos corporativos como miembros de la organización independiente líder en fusiones y adquisiciones, con la seguridad de poder ofrecer a sus clientes un servicio único en el que mantendrá su tradicional enfoque LOCAL con alcance GLOBAL.

[:en]

Albia Capital Partners joins IMAP, the leading global boutique in Middle Market mergers and acquisitions

From the 1st of January 2017, Albia Capital Partners will be integrated into IMAP as the organization’s exclusive firm for Spain.

IMAP is a global company with presence in 35 countries, 67 offices and more than 350 experts in mergers and acquisitions advisory. In the last 10 years, the firm has completed more than 2.200 transactions worth more than $90 billion, 30% of which have recurrently been cross-border.

IMAP is one of the leaders in Middle Market deals, appearing in the last 3 years as the sixth world-wide firm according to Thomson Reuters deal tables for transactions of up to $50 million and the seventh in transactions of up to $100 million. The firm is also the first boutique exclusively dedicated to mergers and acquisitions in this ranking only preceded by companies that offer numerous types of professional services with an overall approach.

In its 12 years of activity, Albia Capital Partners has worked with more than 190 different clients, having completed acquisitions and divestments, valuations, capital raising, joint ventures and refinancing deals, among others. Albia Capital Partners has always been highly committed with its clients in understanding their business and needs, executing its mandates with a LOCAL approach but having always been convinced that most of its projects require solutions from a GLOBAL perspective.

In this period Albia Capital Partners has expanded its services completing transactions in various countries such as United States, India, South Africa, Algeria, United Kingdom, Germany, Kuwait and Czech Republic, among others. This tendency in the internationalization of its services, in line with the needs of its domestic and international clients, has been the key factor in Albia Capital Partners joining IMAP.

Due to this integration in IMAP, Albia Capital Partners has changed its firm name to IMAP Albia Capital, also changing its corporate identity and updating its web page albiacapital.com. However, the most relevant aspect is its integration in a GLOBAL organization in which all of Albia Capital Partner’s clients will be able to leverage their projects in 350 professionals that will also work together for these projects to be successful.

IMAP Albia Capital’s future prospects are not only to continue assisting their clients on making and solving corporate strategies with a more GLOBAL vision, but it will also be focused in offering more and new opportunities to companies and investors. In this sense, IMAP recurrently manages between 350 and 400 mandates (buy-side, sell-side and capital raising) and most of them are excellent opportunities to invest or integrate in relevant GLOBAL projects.

In 2016 IMAP has completed 9 deals in Spain, five of which were solved in the domestic field and the other four were cross-border in which different IMAP offices were participants:

The IMAP Albia Capital team has started a new and exciting period in its project of advising corporate processes as a new member of this leading merger and acquisition organization. All of this within its sustained commitment to render a unique service to its clients, retaining its traditional LOCAL approach with a GLOBAL scope.

[:]